Risk aversion

Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens which may affect market conditions. This behavior is caused when risk averse traders liquidate their positions in risky assets and shift the funds to less risky assets due to uncertainty.

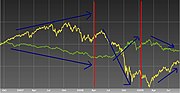

In the context of the foreign exchange market, traders liquidate their positions in various currencies to take up positions in safe-haven currencies, such as the US dollar. Sometimes, the choice of a safe haven currency is more of a choice based on prevailing sentiments rather than one of economic statistics. An example would be the Financial Crisis of 2008. The value of equities across the world fell while the US dollar strengthened (see Fig.1). This happened despite the strong focus of the crisis in the USA.

0 comments:

Post a Comment