Trading characteristics

Most traded currencies by value

Currency distribution of global foreign exchange market turnover

| Rank | Currency | ISO 4217 code

(Symbol) | % daily share

(April 2013) |

|---|

1

|  United States dollar United States dollar |

USD ($)

| 87.0% |

2

|  Euro Euro |

EUR (€)

| 33.4% |

3

|  Japanese yen Japanese yen |

JPY (¥)

| 23.0% |

4

|  Pound sterling Pound sterling |

GBP (£)

| 11.8% |

5

|  Australian dollar Australian dollar |

AUD ($)

| 8.6% |

6

|  Swiss franc Swiss franc |

CHF (Fr)

| 5.2% |

7

|  Canadian dollar Canadian dollar |

CAD ($)

| 4.6% |

8

|  Mexican peso Mexican peso |

MXN ($)

| 2.5% |

9

|  Chinese yuan Chinese yuan |

CNY (¥)

| 2.2% |

10

|  New Zealand dollar New Zealand dollar |

NZD ($)

| 2.0% |

11

|  Swedish krona Swedish krona |

SEK (kr)

| 1.8% |

12

|  Russian ruble Russian ruble |

RUB (₽)

| 1.6% |

13

|  Hong Kong dollar Hong Kong dollar |

HKD ($)

| 1.4% |

14

|  Norwegian krone Norwegian krone |

NOK (kr)

| 1.4% |

15

|  Singapore dollar Singapore dollar |

SGD ($)

| 1.4% |

16

|  Turkish lira Turkish lira |

TRY (₺)

| 1.3% |

17

|  South Korean won South Korean won |

KRW (₩)

| 1.2% |

18

|  South African rand South African rand |

ZAR (R)

| 1.1% |

19

|  Brazilian real Brazilian real |

BRL (R$)

| 1.1% |

20

|  Indian rupee Indian rupee |

INR (₹)

| 1.0% |

| Other | 6.3% |

| Total | 200% |

There is no unified or centrally cleared market for the majority of trades, and there is very little cross-border regulation. Due to the over-the-counter (OTC) nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. This implies that there is not a single exchange rate but rather a number of different rates (prices), depending on what bank or market maker is trading, and where it is. In practice the rates are quite close due to arbitrage. Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. Major trading exchanges include Electronic Broking Services (EBS) and Thomson Reuters Dealing, while major banks also offer trading systems. A joint venture of the Chicago Mercantile Exchange and Reuters, called Fxmarketspace opened in 2007 and aspired but failed to the role of a central market clearingmechanism.

The main trading centers are London and New York City, though Tokyo, Hong Kong and Singapore are all important centers as well. Banks throughout the world participate. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session, excluding weekends.

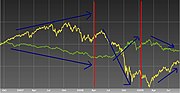

Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows caused by changes in gross domestic product (GDP) growth, inflation (purchasing power parity theory), interest rates (interest rate parity, Domestic Fisher effect, International Fisher effect), budget and trade deficits or surpluses, large cross-border M&A deals and other macroeconomic conditions. Major news is released publicly, often on scheduled dates, so many people have access to the same news at the same time. However, the large banks have an important advantage; they can see their customers' order flow.

Currencies are traded against one another in pairs. Each currency pair thus constitutes an individual trading product and is traditionally noted XXXYYY or XXX/YYY, where XXX and YYY are the ISO 4217 international three-letter code of the currencies involved. The first currency (XXX) is the base currency that is quoted relative to the second currency (YYY), called the counter currency (or quote currency). For instance, the quotation EURUSD (EUR/USD) 1.5465 is the price of the Euro expressed in US dollars, meaning 1 euro = 1.5465 dollars. The market convention is to quote most exchange rates against the USD with the US dollar as the base currency (e.g. USDJPY, USDCAD, USDCHF). The exceptions are the British pound (GBP), Australian dollar (AUD), the New Zealand dollar (NZD) and the euro (EUR) where the USD is the counter currency (e.g. GBPUSD, AUDUSD, NZDUSD, EURUSD).

The factors affecting XXX will affect both XXXYYY and XXXZZZ. This causes positive currency correlationbetween XXXYYY and XXXZZZ.

On the spot market, according to the 2013 Triennial Survey, the most heavily traded bilateral currency pairs were:

- EURUSD: 24.1%

- USDJPY: 18.3%

- GBPUSD (also called cable): 8.8%

and the US currency was involved in 87.0% of transactions, followed by the euro (33.4%), the yen (23.0%), and sterling (11.8%) (see table). Volume percentages for all individual currencies should add up to 200%, as each transaction involves two currencies.

Trading in the euro has grown considerably since the currency's creation in January 1999, and how long the foreign exchange market will remain dollar-centered is open to debate. Until recently, trading the euro versus a non-European currency ZZZ would have usually involved two trades: EURUSD and USDZZZ. The exception to this is EURJPY, which is an established traded currency pair in the interbank spot market.